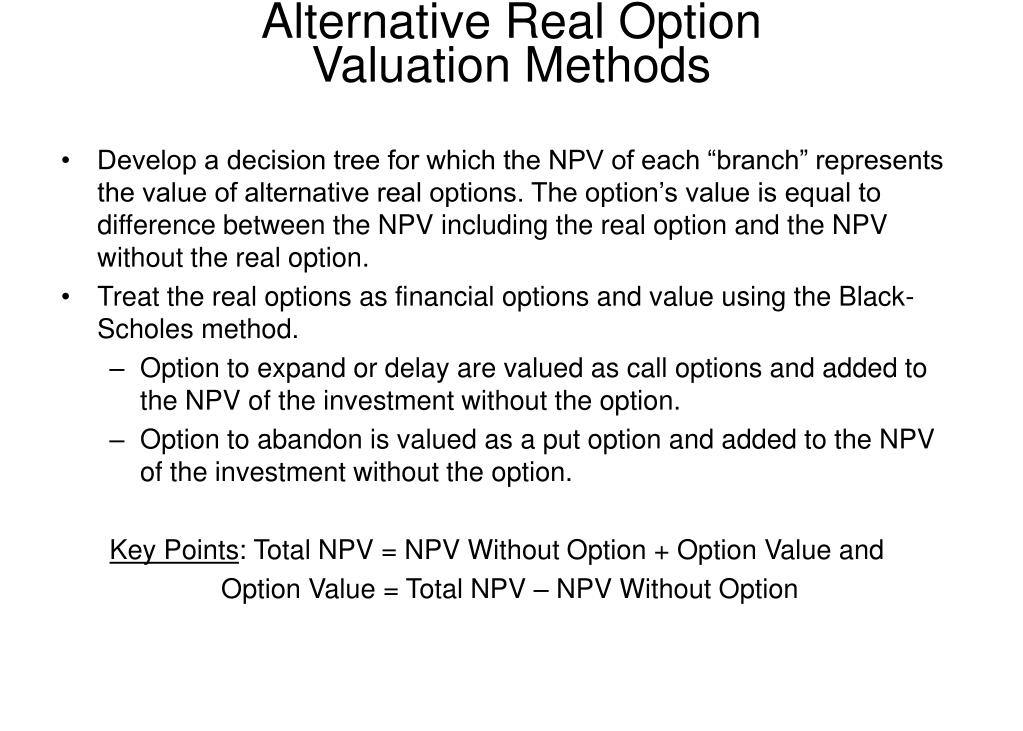

Professor(s) who recently taught this course: Jonathan Parker, Gary Gensler Collapseġ5. It assumes students took a previous introductory course in corporate finance theory and aims to make extensive application of such theoretical background either. The title of this book is An Applied Course in Real Options Valuation (Thomson South-Western Finance) and it was written by Richard L. An Applied Course in Real Options Valuation, Thomson, Mason, 40-145. A widely used method for valuing a financial option is the BlackScholes model, which is typically applied to European options, those that can be exercised only at the expiration. Besides real options, there are other methods that have been applied to climate. A combination of case studies, guest speakers and group discussion provide real-world insight and interactivity, while special review sessions help hone technical skills. The third method involves the valuation of the real option as a put or call, assuming that the underlying asset has the characteristics of a financial option.

Covers past and current innovations and technologies ranging from peer-to-peer lending, AI, deep learning, cryptocurrencies, blockchain technology, and open API's, to the role of FinTech startups. Provides a solid understanding of rational and behavioral aspects of consumer decision-making and how the players, products, funding markets, regulatory frameworks, and fundamentals all interact to shape ever-changing consumer financial markets, including consumer debt, investment, transactions, and advising markets. A real option allows the management team to analyze and evaluate business opportunities and choose the right one. Explores consumer finance and the ways in which financial innovation and new technologies disrupt the financial services industry, leading to material change in business models and product design in financial markets. Getting the books An Applied Course In Real Options Valuation Thomson South Western Financenow is not type of inspiring means.

0 kommentar(er)

0 kommentar(er)